capital gains tax news canada

In Canada 50 of the value of any capital gains is taxable. Net of the 5000 previously-claimed capital gains.

Capital Gains Tax News Videos Articles

Buy Bitcoin with AMEX.

. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. On March 11 Finance Canada released draft legislation on the Luxury Tax that was proposed in the 2021 Federal Budget. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

Your sale price 3950- your ACB 13002650. President Biden wants to raise the capital gains tax that wealthy people pay and use the extra revenue to fund new social spending on children and education. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for.

Since its more than your ACB you have a capital gain. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

The income is considered 50 of the capital gain. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Investors pay Canadian capital gains tax on 50 of the capital gain amount.

In Canada the taxable capital gain must be reported as income on your tax return for the year the asset was sold. When you buy a home you must pay tax on its fair market value at the time of purchase. The total amount you received when you sold the shares was 5000.

The listed personal property rules state that coins with a resale value. Bullion and coins are liable to capital gains tax across Canada subject to personal-use property exemptions. If you bought a cottage for 200000 and now sell it for 500000 you will receive.

When you sold the 100 shares this year you received 50 per share and paid a 50 commission. Subject to parliamentary approval the tax will apply. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Up to CAD 913630 for 2022 indexed thereafter in capital gains on the. For example if you sold an.

A lifetime capital gains exemption LCGE allows a Canadian-resident individual to realise tax free. In 2021 the net capital losses from 2018 can reduce the taxable capital gains to zero leaving 14000 of net capital losses. Balance out your capital losses.

The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate. When investors sell a capital property for more than they paid for it the Canada Revenue Agency CRA applies a tax on. This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say.

Your new cost basis as of Year 5 would be 850000. If you sell 1000 worth of ABC stock and 2000worth of XYZ stock in the same calendar year your net gain is 0 since the gains from. However you would be.

Finance Minister Doesn T Rule Out Future Changes To Capital Gains Taxes Cbc News

Singh Pledges To Crack Down On House Flippers By Hiking Taxable Amount Of Capital Gains National Globalnews Ca

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

The States With The Highest Capital Gains Tax Rates The Motley Fool

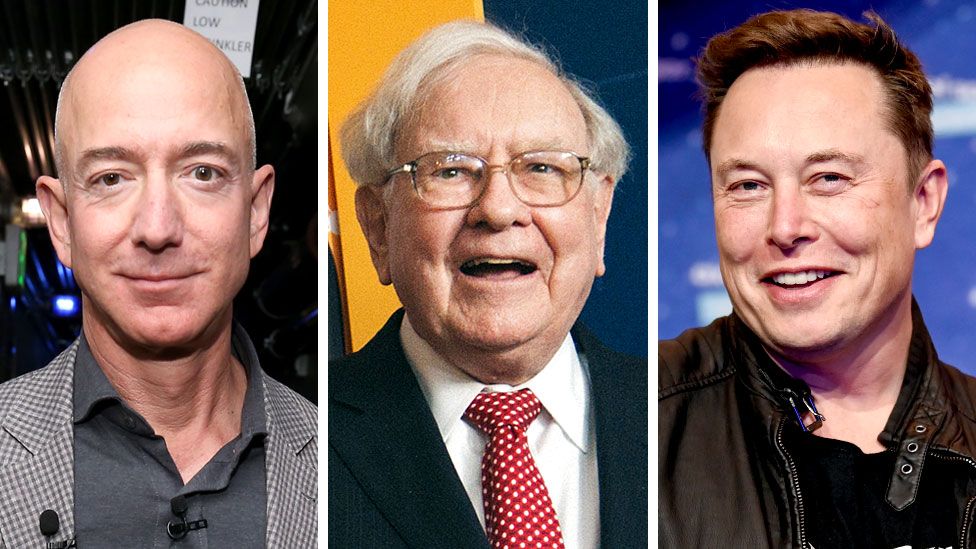

Us Super Rich Pay Almost No Income Tax Bbc News

Crypto Capital Gains And Tax Rates 2022

The Right Capital Gains Tax Rate Is Zero International Liberty

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

Capital Gains Tax Canada 2022 Short Term Long Term Gains Wealthsimple

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

List Of Countries By Tax Rates Wikipedia

Know The Strategies When It Comes To Taxes On Options Ticker Tape

Capital Gains Tax On Stocks What You Need To Know The Motley Fool

Crypto Capital Gains And Tax Rates 2022

Capital Gains Tax Hike Would Be Disastrous For Economic Recovery Fraser Institute