nj property tax relief for veterans

There are two parts to Public Question No. If you need help documenting your veteran status call.

2 days agoBy Submitted Content.

. If you are a qualified Veteran Widow of a Veteran Senior Citizen Disabled Person or Surviving Spouse you may be eligible for deductions which reduce your property tax liability by. About the Company Property Tax Relief For Veterans In Nj. About the Company Nj Property Tax Relief For Veterans.

For Tax Year 2021 and after combat pay is not taxable in New Jersey PL. The Homestead Benefit program provides property tax relief to eligible homeowners. The law excludes military pay for service in a combat zone or for hospitalization as the result of injury while serving in a.

Texas veterans with VA disability ratings between 10 and 100 may qualify for property tax exemptions starting at 5000 for 10-29 disability and ending at a full exemption for those VA-rated as 100 disabled. Arkansas veterans with a 100 Permanent and Total PT VA disability rating are exempt from paying property taxes on their primary residence. MONROE Mayor Stephen Dalina is calling for more state property tax relief.

Benefits are expected to be credited to eligible taxpayers in two payments first in February 2021 and the second payment in May. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023. Other Property Tax Benefits Administered by the local municipality Last Updated.

Military pay is taxable for New Jersey residents including combat zone pay received in 2020 and prior. To file an application by phone1-877-658-2972. NJ Election 2020.

If you have questions call your local assessor or tax collector or call the Division of Taxation at 609-292-7974. Resident tax return etc. Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219.

Those over the age of 65 may also qualify for additional property tax exemption programs. Public Law 2019 chapter 203 extends the annual 250 property tax deduction to veterans or their surviving spousecivil uniondomestic partner who are residents of a continuing care retirement community CCRC. Phil Murphy spoke at the Department of Military and Veterans affairs Memorial Day ceremony in Wrightstown May 25.

CuraDebt is a debt relief company from Hollywood Florida. The Office of Legislative Services estimates the. Veterans who own less than 5000 worth of property or 10000 worth for a married couple or surviving spouse 4000 exemption for real or personal property.

Primary residence completely exempted from taxes. Property Tax Reimbursement Senior Freeze Program. Property Tax Deductions Senior Citizens Veterans and Surviving Spouses If you are a qualified Veteran Widow of a Veteran Senior Citizen Disabled Person or Surviving Spouse you may be eligible for deductions.

Here are the details who would benefit and what it could cost. Property Tax Relief Forms. It was founded in 2000 and is a member of the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators.

2020 veteran applicants for the 100 Disabled Veteran Property Tax Exemption were no longer required to have served in specific geographic locationsconflict zones but were still required to have served during a. 100 disability rating blind in both eyes or has lost the use of two or more limbs. It was founded in 2000 and has since become a member of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators.

The most common programs are as follows. RESIDENCY - New Jersey drivers license or motor vehicle registration voters registration NJ. The State of New Jersey offers tax relief in various forms to certain property owners.

Military pay is taxable for New Jersey residents including combat zone pay received in 2020 and prior. The 2021 property tax credits are based on ones 2017 income and property taxes paid. Ballot question asks voters if they want to extend property-tax relief for military veterans.

CuraDebt is a company that provides debt relief from Hollywood Florida. New Jersey Department of Military and Veterans Affairs 609-530-6958 or 609-530-6854. 250 Veterans Property Tax Deduction Effective December 4 2020 State law PL.

Military and Veteran Tax Benefits New for 2021 - Income Tax. Military Personnel Veterans New for 2021 - Income Tax. Determine if You Are Eligible for NJ Property Tax Relief.

The main reasons behind the steep rates are high property values and education costs. To qualify for the exemption the veteran must own the property and must have a 100 Permanent and Total PT VA disability rating OR have been awarded Special Monthly Compensation by VA for 1 The loss or loss of. Veteran Property Tax Deduction and the Disabled Veteran Property Tax Exemption.

The law also exempts service people from paying New Jersey Income Tax on their wages if they are being. Your municipal tax assessor or collector. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019.

For Tax Year 2021 and forward combat pay is not taxable in New Jersey PL. Ad Search For Info About Nj property tax relief. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces what you owe in property tax.

Applications for the homeowner benefit are not available on this site for printing.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

Veteran Tax Exemptions By State

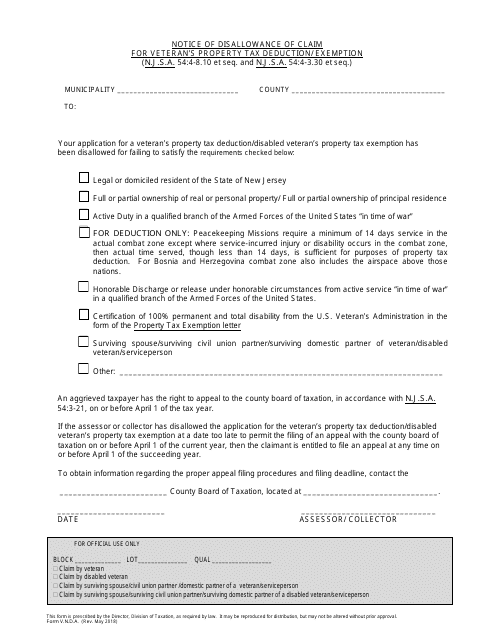

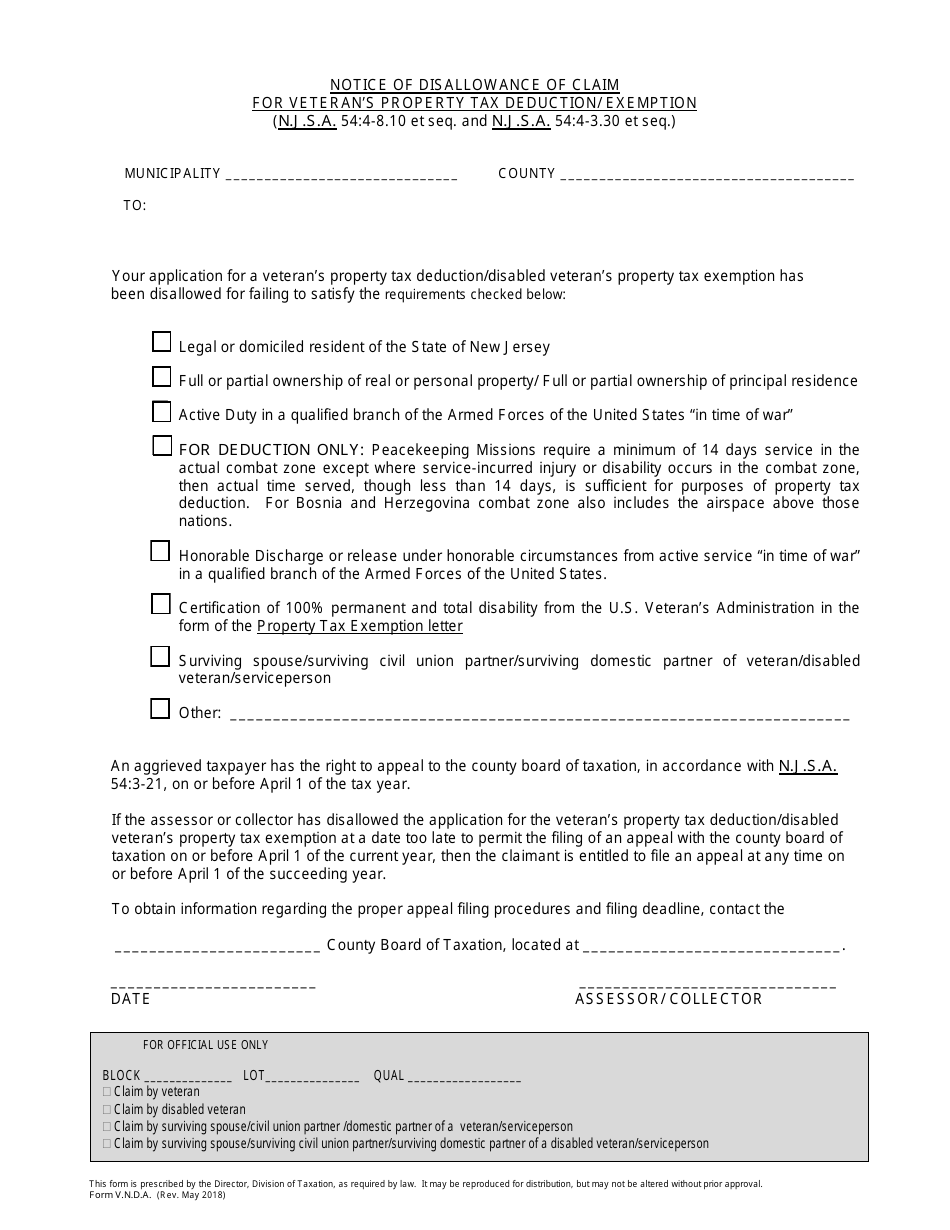

Form V N D A Download Fillable Pdf Or Fill Online Notice Of Disallowance Of Claim For Veteran S Property Tax Deduction Exemption New Jersey Templateroller

Murphy Proposes 900m Anchor Property Tax Relief Program New Jersey Business Magazine

Veteran Tax Exemptions By State

Freehold Township Sample Tax Bill And Explanation

Veteran Tax Exemptions By State

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

Freehold Township Sample Tax Bill And Explanation

Veteran Disability Exemptions By State Va Hlc

Form V N D A Download Fillable Pdf Or Fill Online Notice Of Disallowance Of Claim For Veteran S Property Tax Deduction Exemption New Jersey Templateroller

New Jersey Military And Veterans Benefits The Official Army Benefits Website

Property Tax Deductions Over 65 And Disabled Person Mortgagemark Com

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Form V N D A Download Fillable Pdf Or Fill Online Notice Of Disallowance Of Claim For Veteran S Property Tax Deduction Exemption New Jersey Templateroller

States With Property Tax Exemptions For Veterans R Veterans

Bill Making Totally Disabled Veterans Property Tax Exemption Retroactive Advances Edison Nj News Tapinto

New Jersey Military And Veterans Benefits The Official Army Benefits Website